HBL Solar Financing for Domestic & Commercial Users. A Complete Guide

With the growing demand for sustainable solar energy in the world, solar power has also become a favorite option in Pakistan. However, the high initial expenses or the upfront costs of solar system installation can be unaffordable for many households and businesses.

To address this issue, Habib Bank Limited (HBL) is offering the HBL Solar Financing scheme, making solar energy more accessible and cheap to consumers.

In this post, we will dig deeper into the HBL Solar Financing program, its features, benefits, and eligibility criteria in depth.

It can help you choose and invest in a better solar system, click tomlearn more.

HBL Solar Financing Eligibility Criteria:

The eligibility criteria for the HBL Solar Financing program include the following requirements:

- Nationality: Pakistani national having a Computerized National Identity Card

- Age: Applicant must be between 21 and 65 years old.

- Income: Applicant’s regular income source should meet the minimum income requirements set by HBL.

- Credit History: Applicant must have a reasonable credit history & score to avail of the financing program.

- Property Ownership: Applicant must own a property where the solar system is intended to be set up

- Tax Payee: Applicant must be an active tax payee with NTN number

Motive Behind HBL Solar Financing:

Financing is available to solve the challenges of energy shortage and climate change by promoting renewable energy. The scheme is classified into 3 primary categories.

- Category I: Solar energy power projects with a capacity lying between 1MW to 50MW.

- Category II: Solar energy power projects with a capacity lying below or up to 1MW.

- Category III: Vendors and suppliers accredited under the AEDB Certification Regulation 2018 for leasing wind and solar systems or selling power to end consumers.

Loan Funds Amount:

- Category I: PKR 06 billion for a single solar project.

- Category II: PKR 400 million for a single applicant.

- Category III: PKR 01 billion for a single vendor (supplier).

Markup Rate:

- 6% per annum or as per the latest SBP directions

Repayment Tenure:

- Category I: Maximum 12 years (including 02 years grace period)

- Category II: Maximum 10 years (including 03 months grace period)

- Category III: Maximum 10 years

What is the HBL Solar Financing Program

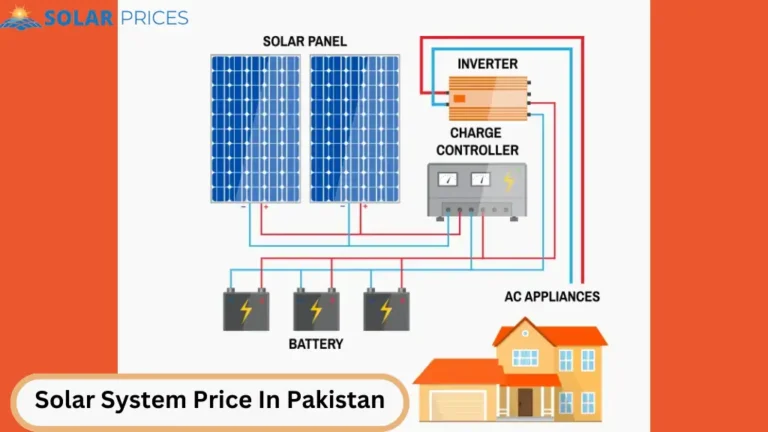

The HBL Solar Financing Scheme is intended to provide financial support and encouragement to clients who want to install solar systems (panels) on their property but cannot afford the initial cost.

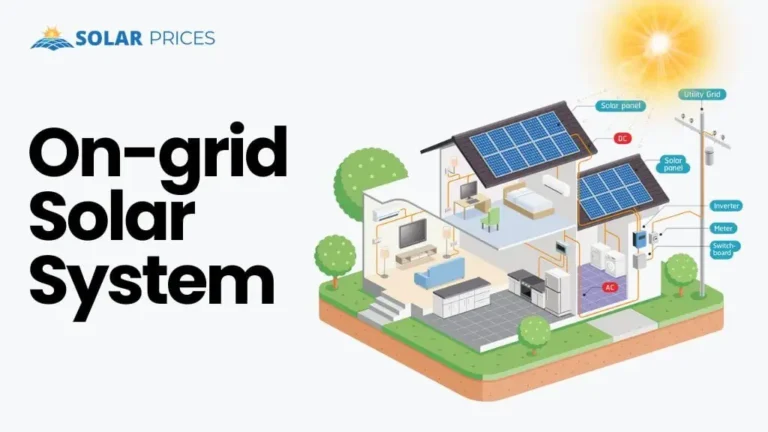

The program provides a variety of financing options, including personal loans, home loans, and business loans, designed to meet the varying needs of customers for off-grid, on-grid, or hybrid solar systems.

Why Should You Partner with HBL?

Electricity costs are getting too expensive, and the initial expense of installing a solar system is not affordable for everyone.

In such situations, the solar financing option offered by Pakistan’s Habib Bank Limited is a comfort of pleasure for citizens, who can take advantage of this chance by approaching their respective branches all across Pakistan.

All major commercial banks in Pakistan offer solar system installment plans and loans for solar systems. This also encourages the use of renewable energy sources and minimizes dependency on expensive imported fuel.

The eligibility requirements are also reasonable, and the markup (interest rate) is affordable to all customers. Being Muslim, you should first try for an Islamic solar financing program.

This plan allows you to install solar panels on installment in Pakistan and generate your own electricity at home.

Key Features of the HBL Solar Financing Scheme

The HBL Solar Financing Scheme provides the following major features to its customers or solar prospects:

Flexible Loan Tenure: Loan repayment is made simple by different categories. The loan term might range from 1 to 12 years at the most, depending on the category. The loan repayment period may also depend on the loan amount and the customer’s repayment capacity.

Competitive Interest Rates: Generally, interest rate is one of the biggest concerns related to financing. HBL has a strong focus on engaging solar prospects promising a very competitive interest rate.

This is mainly done due to a customer-centric approach and to enhance solar adoption across the country. Here, HBL provides reasonable interest rates on solar financing, making it an affordable option for customers.

No Prepayment Penalty: Sometimes, a person wants to repay before the time of payment to lessen his concerns. Keeping this in view, HBL lets its customers make prepayments or early repayments without paying any penalties or additional fees.

Quick Loan Filing and Processing: HBL guarantees speedy loan processing and disbursement, making it a convenient choice for customers looking to install solar panel systems.

Free Solar Assessment: When planning to install a solar system, every individual faces a problem with solar system size estimation. But, don’t worry about it because HBL provides its customers with a free solar energy assessment service.

This feature is focused on assisting them choose the best size and configuration of solar panel systems for their homes or businesses.

Major Benefits of HBL Solar Financing

The HBL Solar Financing program provides multiple key benefits to its customers, including:

- Lower Upfront Cost: Solar panel installation can be costly, but the HBL Solar Financing program makes it more affordable for customers by offering assistance with financing.

- Reduced Electricity Bills: The use of solar panels generates electricity from renewable resources, reducing customers’ reliance on traditional grid-based power and allowing them to save money on their utility bills.

- Environmentally Friendly: Solar panel systems are a clean, renewable energy source that helps to minimize carbon emissions and safeguard the environment.

- Increased Property Value: A solar system has 25 years of working lifespan. So, solar systems can raise the value of a property, making them a good investment for homeowners.

Limitations of Solar System and HBL Financing

Despite its numerous benefits, a solar system and the HBL Solar Financing scheme have a few limitations, including:

- Tough eligibility criteria for financing

- Solar panel system maintenance cost

- Weather dependence of the solar system

Conclusion

The HBL Solar Financing program is an ideal option for clients who wish to install solar systems (solar panels) but need help to afford the expensive initial investment.

The financing program provides users with various benefits, including a flexible loan tenure, competitive interest rates, and swift processing. Customers must also evaluate the program’s limitations and solar drawbacks such as qualifying requirements, maintenance expenses, and weather dependence.

Overall, the HBL Solar Financing program is a step toward boosting renewable energy adoption and making it more easily affordable to Pakistan’s average citizens.

FAQs:

What is the interest rate for an HBL loan?

There is no simple answer to this query because the interest rate varies from customer to customer. If you are interested in HBL solar financing, you can apply for HBL solar financing online. For further details, read the above post. However, it will be a maximum of up to 35.99% per annum.

Which bank is offering solar financing in Pakistan?

Various commercial banks in Pakistan are providing solar financing schemes. This scheme offers a 6% markup if refinanced through SBP. You can apply for solar energy system financing from HBL Bank if you are a Pakistani national within the age bracket of 21 to 65 years.